- Syndication Launch Newsletter

- Posts

- Syndication Launch Newsletter #00111

Syndication Launch Newsletter #00111

What Type of Real Estate Investor Are You?

What Type of Real Estate Investor Are You?

Every successful commercial real estate investor has one thing in common: Clarity.

Clarity on their goals.

Clarity on their strengths.

Clarity on their strategy.

But here’s the catch—most aspiring investors never stop to ask who they really are in this business. And as a result, they waste years chasing deals that don’t fit, copying strategies that don’t align, and partnering with people who pull them off course.

This week, we’re flipping the lens. Before you add another property to your pipeline, ask yourself:

What Type of Real Estate Investor Are You?

Here are five archetypes we see most often in the CRE world. You might be one—or a mix—but knowing your core identity will sharpen your edge.

1. The Deal Maker

You live for the chase. Sourcing off-market deals, negotiating with sellers, getting creative with capital stacks—that’s your zone of genius.

You're not always the most detail-oriented operator, but you know how to bring the right people together to make a deal work.

Superpower: Vision and persuasion.

Watch out for: Overcommitting to too many deals at once.

2. The Capital Connector

Your network is your net worth. You’re a natural at raising equity, building trust with investors, and explaining complex deals in plain language.

You're drawn to syndication because you know how to align incentives and make people feel safe putting money into big projects.

Superpower: Investor relations and capital strategy.

Watch out for: Getting too dependent on others for deal flow.

3. The Operator

You're the glue that holds the asset together post-close. You love the process—due diligence, leasing strategies, value-add execution, and hitting pro forma targets.

Operations isn't always glamorous, but you're the one who actually turns the deal into a win.

Superpower: Execution and asset management.

Watch out for: Staying stuck in the weeds and not scaling through systems.

4. The Strategist

You see the big picture. You’re constantly reading market trends, underwriting scenarios, and asking “what if?”

You’re analytical, forward-thinking, and often a great partner to the more action-oriented types.

Superpower: Market timing and risk management.

Watch out for: Analysis Paralysis.

5. The Builder

You want to own and operate your own portfolio long-term. Maybe syndication is your vehicle—or maybe you’re using it to learn, grow, and eventually pivot into full-time ownership.

You think like a founder, and your focus is long-term equity, generational wealth, and building something that lasts.

Superpower: Grit and long-term vision.

Watch out for: Trying to do it all alone.

So… Who Are You?

You don’t have to fit into just one box.

But knowing your dominant type will help you find better partners, focus your energy, and build a business that feels right for you.

The biggest breakthroughs come when you stop trying to be everything—and start doubling down on your lane.

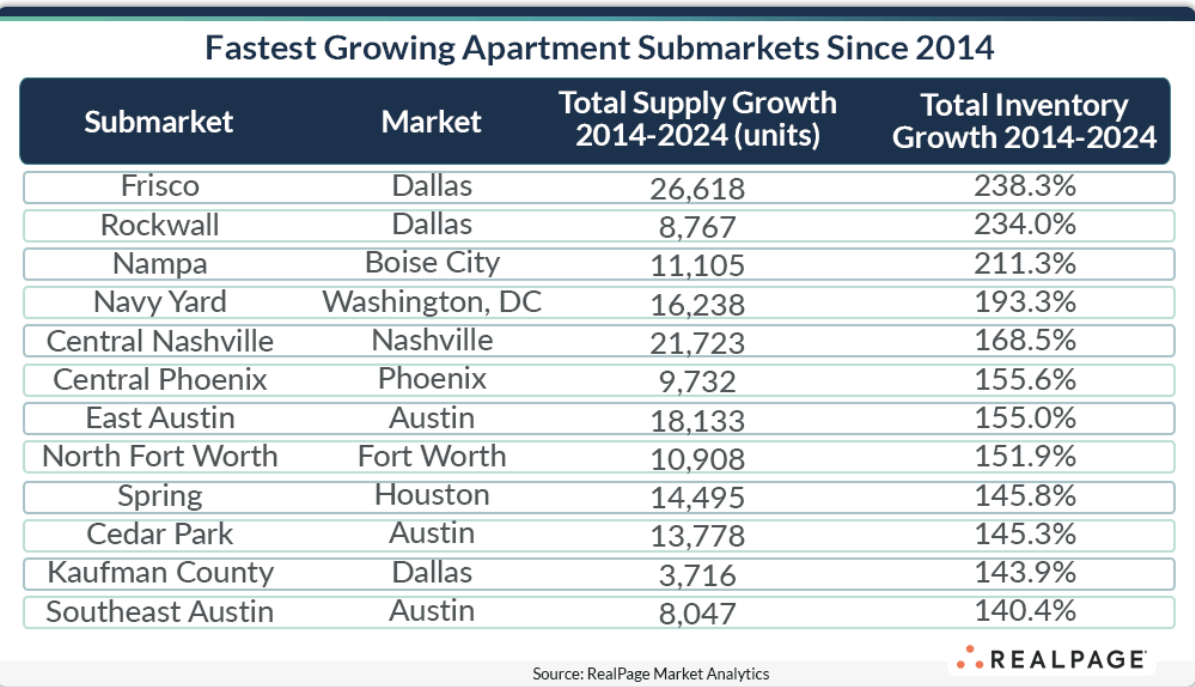

Texas Submarkets Experience Explosive Apartment Inventory Growth

Hold onto your ten-gallon hats, folks—Frisco, Texas, is redefining "boomtown." Over the past decade, this Dallas suburb's apartment inventory has skyrocketed by a jaw-dropping 238.3%, adding a whopping 26,618 new units. To put that in perspective, that's more than tripling its existing stock, outpacing even urban heavyweights like Brooklyn and Jersey City. Frisco's allure isn't just in numbers; it's become a magnet for new residents, thanks to its rapid development and burgeoning job market.

Meanwhile, down in Austin, the eastern neighborhoods are turning heads. East Austin has undergone a remarkable transformation, with its apartment inventory surging by 155% over the past ten years, welcoming over 18,100 new units. Neighboring Southeast Austin isn't far behind, boasting a 140.4% increase with approximately 8,000 new apartments. This explosive growth is largely attributed to the completion of Texas State Highway 130 in 2012, which opened up these areas to development and made them prime spots for new residents seeking modern living spaces.

CRE Terminology of the Week

Privatization

Privatization in commercial real estate refers to the process of transferring ownership of a property or portfolio from the public sector (government-owned) or public markets (REITs, publicly traded companies) into private ownership.

This could look like:

A government selling off surplus land or buildings to private developers.

A public REIT being taken private by a private equity firm or consortium of investors.

Municipal housing or infrastructure being turned over to private operators through long-term leases or sales.

Listen to the latest episode of Disruptive Capitalist podcast hosted by Sam Sells. Join our free Facebook Community. | Join our weekly webinar: How to build wealth and solve the affordable housing crisis. Book a call with our team. |

Stay ahead of the curve in commercial real estate by joining our group calls. Each week, we bring you the latest trends, insights, and opportunities to help you succeed as a syndicator!

Have questions? contact [email protected]